National gold price today 04/05/2025

At the time of the survey at 1:30 p.m. on May 4, 2025, the gold price reached a summit of 121 million VND. Specifically:

The price of SJC gold ingots listed by Doji Group is 119.3-121.3 million VND/TAEL (Purchase – Sale), the price remains unchanged in both directions of purchase and sale compared to yesterday. Compared to last week, the price of gold increased by 300,000 VND/Tael in both directions, to purchase as for sale.

At the same time, the price of SJC gold ingots was listed by Saigon Jewelry Company Limited – SJC at 119.3-121.3 million VND/TAEL (Purchase – Sale), the price remained unchanged in both directions of purchase and sale compared to yesterday but increased by 300,000 VND/Tael in the two directions of purchase and sale compared to last week.

At Mi Hong Jewelry Company, the Mi Hong Gold Prize at the time of the survey indicated that the price of SJC gold was 118 to 119.5 million VND/Tael for purchase and sale. Compared to yesterday, gold prices remained unchanged in both directions of purchase and sale. Compared to last week, the price of gold decreased by 1 million VND/Tael to purchase and by 1.5 million VND/Tael for sale.

The price of SJC gold at Bao Tin Minh Chau Company Limited is negotiated by companies at 118.3-121 million VND/TAEL (purchase – sale, unchanged in both directions of purchase and sale compared to yesterday. Decrease of 700,000 VND/TAEL in the direction of purchase – unchanged in the direction of sale compared to last week.

The price of SJC gold to Phu Quy is negotiated by companies at 118.3-121.3 million VND/Tael (purchase – sale), the price of gold remains unchanged in both directions of purchase and sale compared to yesterday. The price of gold decreased by 200,000 VND/Tael in terms of purchase price – and increased by 300,000 VND/Tael in terms of selling price compared to last week.

From 1:30 pm today, the price of round rings in gold 9999 Hung Thinh Vuong at Doji is listed at 114-116.5 million VND/Tael (purchase – sale); Unchanged in both directions of purchase and sale compared to yesterday and compared to last week.

Bao Tin Minh Chau next to the price of gold rings at 116.6-119.7 million VND/Tael (purchase – sale); Unchanged in both directions of purchase and sale compared to yesterday; Decrease of 400,000 VND/Tael to purchase – drop by 300,000 VND/Tael for sale compared to last week.

The last list of gold prices today, on May 4, 2025, is as follows:

| Gold price today | May 4 2025 (millions of dongs) | Difference (Mille Dong/Tael) | ||

| Acheter | Sell | Acheter | Sell | |

| SJC in Hanoi | 119,3 | 121,3 | – | – |

| Doji group | 119,3 | 121,3 | – | – |

| Red eyelashes | 118 | 119,5 | – | – |

| PNJ | 119,3 | 121,3 | – | – |

| VietinBank Gold | 121,3 | – | ||

| Tin Tin Minh Chau | 118,3 | 121 | – | – |

| Phu Quy | 118,3 | 121,3 | – | – |

| 1. Doji – Update: 04/05/2025 13:30 – Source website time – ▼/▲ compared to yesterday. | ||

| National Gold Prize | Acheter | Sell |

| AVPL/SJC HN | 119 300 | 121 300 |

| AVPL/SJC HCM | 119 300 | 121 300 |

| AVPL/SJC DN | 119 300 | 121 300 |

| Raw material 9999 – HN | 113 800 | 115 600 |

| Raw material 999 – HN | 113 700 | 115 500 |

| 2. PNJ – Update: 04/05/2025 13:30 – Source site time – ▼/▲ compared to yesterday. | ||

| Taper | Acheter | Sell |

| Golden ingot SJC | 11 930 | 12 130 |

| Simple NPC ring 999.9 | 11 400 | 11 700 |

| Kim Bao Gold 999.9 | 11 400 | 11 700 |

| Or Phu Loc Loc Tai 999,9 | 11 400 | 11 700 |

| Gold jewelry 999.9 | 11 400 | 11 650 |

| Gold jewelry 999 | 11 388 | 11 638 |

| Gold jewelry 9920 | 11 317 | 11 567 |

| 99 gold jewelry | 11 294 | 11 544 |

| 750 pieces of gold (18 carats) | 8.003 | 8 753 |

| 585 Or (14K) | 6 080 | 6 830 |

| 416 gold coins (10,000) | 4.111 | 4 861 |

| PNJ Gold – Phénix | 11 400 | 11 700 |

| Or 916 (22 carats) | 10 431 | 10 681 |

| 610 pieces of gold (14.6 carats) | 6 372 | 7.122 |

| 650 pieces of gold (15.6 carats) | 6 838 | 7 588 |

| 680 pieces of gold (16.3 carats) | 7 187 | 7 937 |

| 375 pieces of gold (9 carats) | 3 634 | 4 384 |

| 333 Or (8K) | 3.110 | 3 860 |

| 3. SJC – Update: 04/05/2025 13:30 – Source site time – ▼/▲ compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119 300 | 121 300 |

| SJC or 5 chi | 119 300 | 121 300 |

| Or SJC 0.5 Chi, 1 Chi, 2 Chi | 119 300 | 121 300 |

| Gold SJC ring 99.99% 1 chi, 2 chi, 5 chi | 114 000 | 116 500 |

| SJC gold ring 99.99% 0.5 chi, 0.3 chi | 114 000 | 116 600 |

| 99.99% jewelry | 114 000 | 115 900 |

| 99% jewelry | 110 752 | 114 752 |

| 68% jewelry | 72 969 | 78 969 |

| 41.7% jewelry | 42 485 | 48 485 |

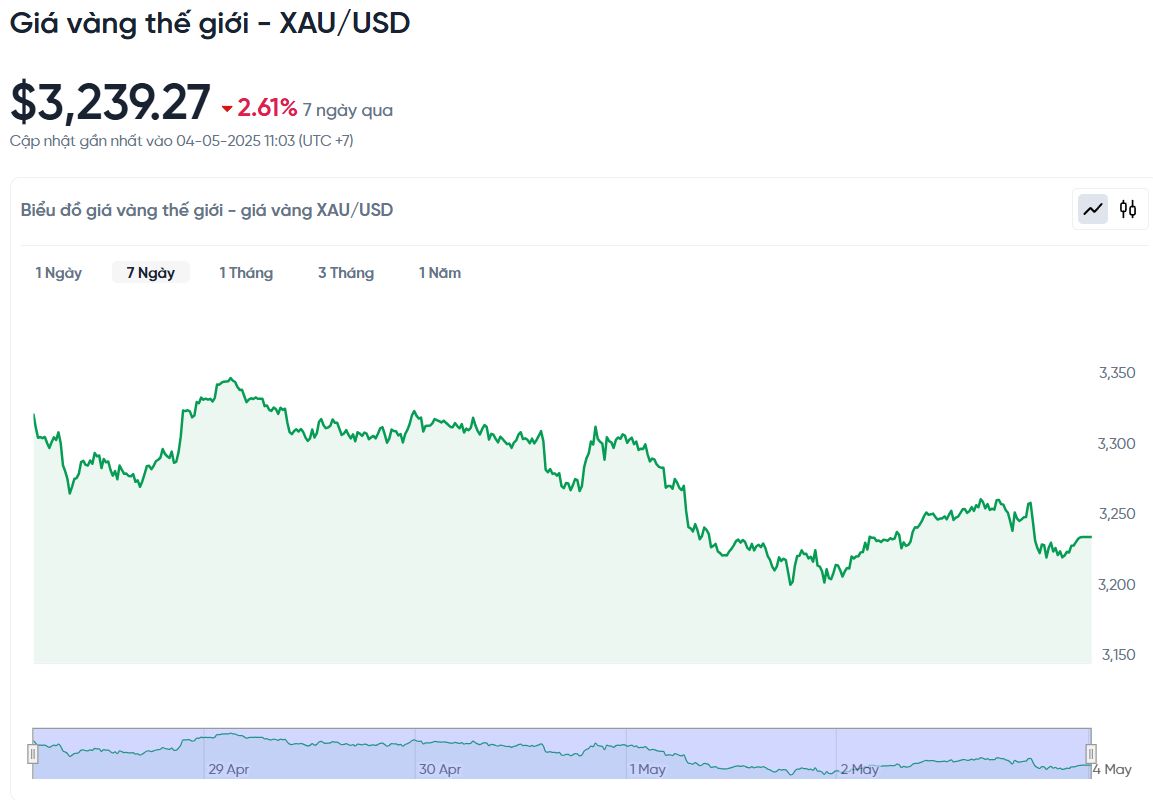

Global gold lesson today 05/04/2025 and graphic for the fluctuations of the World Gold course in the last 24 hours

According to Kitco, the world price of gold was recorded at 1:30 p.m. Today, Vietnam time, the price was 3,239.27 USD/OCE. The price of gold today is unchanged compared to yesterday and down 86.98 USD/OCE compared to last week. Converted according to the USD exchange rate of Vietcombank (26,180 VND/USD), global gold costs around 103.27 million VND/Tael (excluding taxes and fresh). Thus, the price of SJC gold ingots is 18.03 million VND/Tael higher than the international gold price.

World gold prices ended the week down 2.61% compared to last week. According to experts, there is no sign of panic on the market. This suggests that gold prices could enter an accumulation phase in a high price area. Gold prices are still stable in this short -term resistance area, but to accelerate again, gold prices must exceed the 3,300 dollars mark, said Expert Phillip Streible.

Although prices have dropped by more than 7 % compared to a $ 3,500 peak, gold prices have been increasing almost 24 % since the start of the year, which shows that the long -term upward trend has not been broken. According to Mr. Michael Brown of Pepperstone, current correction is a good purchase opportunity, because the long -term perspectives for gold remain very solid, especially in the context of the many uncertainties of the Trump administration and the slowdown of the American economy.

Ole Hansen of Saxo Bank also believes that it is time to take advantage of the correction to buy, but it notes that gold prices can further drop. Hansen said he would closely monitor the reaction of Chinese investors when they return to the market after extended holidays.

A factor that could act as a catalyst next week is the monetary policy meeting of the American Federal Reserve. Although the American economy slows down, recent data still shows considerable resilience. GDP in the first quarter dropped by 0.3% due to a sharp increase in imports, while the labor market, although difficulty in certain areas, remained stable with 177,000 new jobs last month, exceeding forecasts.

Unemployment remained 4.2 % and wages increased regularly. Inflation also shows no sign of increase. This could encourage the Fed to consider changing position at its next meeting, even if it has so far maintained a neutral position and is not in a hurry to reduce interest rates.

Many investors expect the Fed to announce a new softening. According to Naeem Aslam of Zaye Capital Markets, recent data weakened the arguments in favor of maintaining high interest rate. He said the current correction makes gold prices more attractive, attracting a large number of investors to buy at the lowest.

However, Aslam has also warned that the market will be very sensitive both to Fed’s monetary policy and to the evolution of world trade. He said that cooling signals from pricing voltages are positive, but could also limit the increase in short -term gold prices.

Other experts, such as Carsten Fritsch from the Commerzbank, said that market expectations that the Fed could reduce its interest rates up to 90 base points this year were too high. If the Fed fails to do so, gold prices could be exposed to a new correction as expectations are readjusted.

During the coming week, investors will closely follow the main economic events: the PMI index of the ISM services on Monday, the Fed’s decision on interest rates on Wednesday, the Bank of England and the weekly report on requests for unemployment benefits on Thursday. These will be key factors that can strongly influence the next gold prices department.

Gold price forecasts

The weekly Kitco News gold investigation shows that Wall Street experts are leaning for the possibility of new gold prices decreases. Among the 18 experts interviewed, half provided a drop in prices, 28 % an increase and 22 % stagnation. On the other hand, individual investors remain rather optimistic. Among the 273 people interviewed as part of an online survey, 52 % think that the price of gold will increase next week.

The pressure on gold prices now comes mainly from anticipations that US interest rates will remain high in the short term. In addition, positive signals from trade negotiations between the United States and China has reduced gold demand as a refuge value.

John Weyer of Walsh Trading said that gold prices are still dominated by information related to customs tariffs, including unconfirmed rumors. He predicts that gold prices will evolve laterally in the short term but with large fluctuations, because although it is a safe asset, gold remains very sensitive to market fluctuations.

According to Barchart Darin Newsom’s expert, the technical graph shows that the short -term trend in term contracts on June gold is still a lowered. Sharing the same point of view, Alex Kuptsikevich of FXPro said that the sales pressure increased over the weekend. He estimated that in early April, buyers controlled the market, but that the sellers are now testing the support around $ 3,200 an ounce.

If prices continue to drop, gold prices could return to the $ 2,900 area and could even slide $ 2,600-2,700 per ounce if the sale accelerates.

Mr. Fawad Razaqzada of City Index also commented that gold could continue to lose value, even exceeding the $ 3,200 ace mark, as housing demand gradually decreases in a context of predominant economic optimism.

Some experts such as Michael Moor and Fawad Razaqzada warn that if the optimistic feeling persists and that the dollar increases, gold could fall deep to the $ 3,000 mark on the ounce.

However, the CPM group believes that gold prices are getting closer to a short -term floor in May. They recommend that investors consider buying when gold adjusts to the range of 3,000 to 3,150 USD/OCE.

Next week, market attention will be paid to the monetary policy meeting of the American federal reserve on Wednesday. Even if the Fed should maintain its interest rates unchanged, investors will continue to closely monitor President Jerome Powell in order to detect signs of the next management of monetary policy.