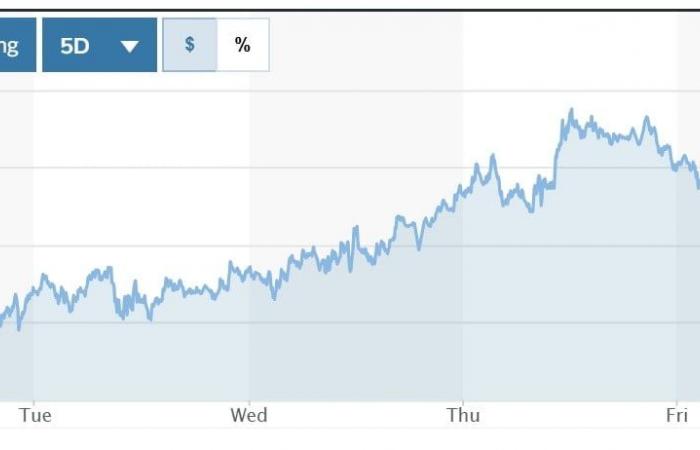

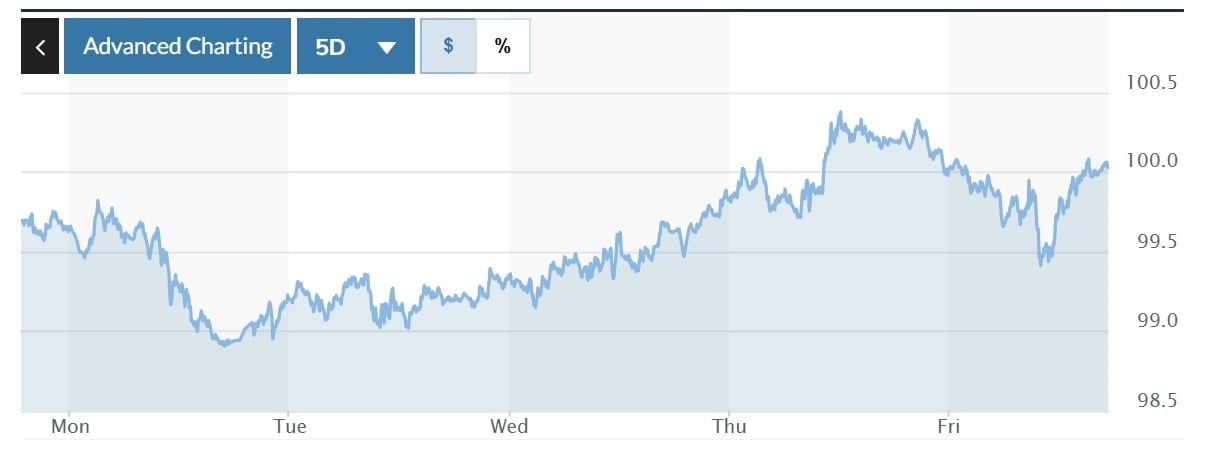

The USD index (Dxy), which measures the performance of the greenback compared to six major currencies, dropped by 0.57% this week to 100.04.

US dollar exchange rate in the world last week

The US dollar dropped 0.53% to 98.94 at the start of the session on Monday, while investors were waiting for new news on US trade policy with caution and preparing for a week of significant economic data. The greenback has reduced its monthly losses to the Euro and Yen at the end of last week, in a context of positive evolution of relations between the United States and China. The Trump administration expressed its opening to the reduction of customs duties and China has exempted certain imports from its 125 %tariff. However, while Mr. Trump insisted that there had been progress and he spoke with President Xi Jinping, China denied that commercial negotiations are taking place.

|

| Volatility graph of the Dxy index during last week. Photo: Marketwatch |

The greenback increased by 0.20% to 99.21 on April 30, stimulated by the Trump administration plan aimed at mitigating the impact of customs tariffs on local car manufacturers, as well as by the prospect of tariff agreements with certain business partners. The dollar also benefited from end -of -month purchases, investors seeking to rebalance their portfolios after the US president’s announcement on customs rates led to a massive sale of American shares and bonds in April. The dollar also benefited from a boost after comments from the American secretary to the Treasury, Scott Bessent, who said that the administration made significant progress in the tariff negotiations, highlighting the coming agreements with India and South Korea. He said he would have discussions with at least 17 business partners in the coming weeks.

The index Dxy continued to increase by 0.40% to 99.64 on May 1 after new data showed that the largest economy in the world has contracted in the first quarter, worse than market expectations, but better than what of the largest American banks predicted. The gross domestic product (GDP) fell 0.3% in the first quarter, penalized by a sharp increase in imports aimed at buying goods before the Trump administration imposes customs duties on most goods, according to a report by the Ministry of Commerce. In addition, before tax imports also increased by 41.3 % in the first three months of the year.

The dollar was up 0.71% on May 2 to 100.18, helped by a few purchases after excessive sale last month, in a context of investors optimism concerning tariff agreements between the United States and its business partners.

The greenback ended the week down 0.21% to 100.04, the data showing that the largest economy in the world has created more jobs than expected last month, reflecting a solid labor market. At the same time, the employment report has strengthened the expectations that the American Federal Reserve (Fed) will maintain its unchanged interest rates during the next meetings and will not reduce them before the summer. American data showed that non -agricultural jobs increased by 177,000 jobs last month after a revised increase of 185,000 in March. The economists interviewed by Reuters provided approximately 130,000 new jobs in April, after a previous report had shown that 228,000 new jobs had been created in March. Economists expect employment growth in the coming months, given the consequences of customs tariffs.

|

| USD exchange rate today 4-5: the USD continues to increase this week. Illustration photo: Reuters |

National dollar exchange rate American today

On the internal market, at the start of the May 4 negotiation session, the State Bank announced that the central exchange rate of the Vietnamese Dong compared to the US dollar had increased by 8 VND this week, to currently stand at 24,956 VND.

* The reference exchange rate rate at the State Bank Transaction Office for purchase and sale remains unchanged, currently at: 23,759 VND – 26 153 VND.

US dollar exchange rates in commercial banks are as follows:

| US dollar exchange rate | Acheter | Sell |

| Vietcombank | 25 790 VND | 26 180 VND |

| Vietnamese bank | 25 670 VND | 26 180 VND |

| BIDV | 25 800 VND | 26 160 VND |

* The EUR exchange rate at the exchange and sales exchange office of the State Bank remains unchanged, currently at: 27,033 VND – 29,879 VND.

EUR exchange rates in commercial banks are as follows:

| EUR exchange rate | Acheter - | Sell |

| Vietcombank | 28 797 VND | 30 445 VND |

| Vietnamese bank | 28 798 VND | 30 508 VND |

| BIDV | 29 152 VND | 30 417 VND |

* The Japanese Yen exchange rate at the State Bank exchange office for purchase and sale remains unchanged, currently at: 167 VND – 184 VND.

| Japanese yen exchange rate | Acheter | Sell |

| Vietcombank | 175,59 VND | 187,18 VND |

| Vietnamese bank | 178,74 VND | 188,44 VND |

| BIDV | 178,74 VND | 187,04 VND |

Minh Anh

* Please visit the section Economy To see the news and related articles.

Source : https://baodaknong.vn/ty-gia-usd-hom-nay-4-5-dong-usd-duy-tri-da-tang-tuan-251370.html